Reinier advises national and international companies

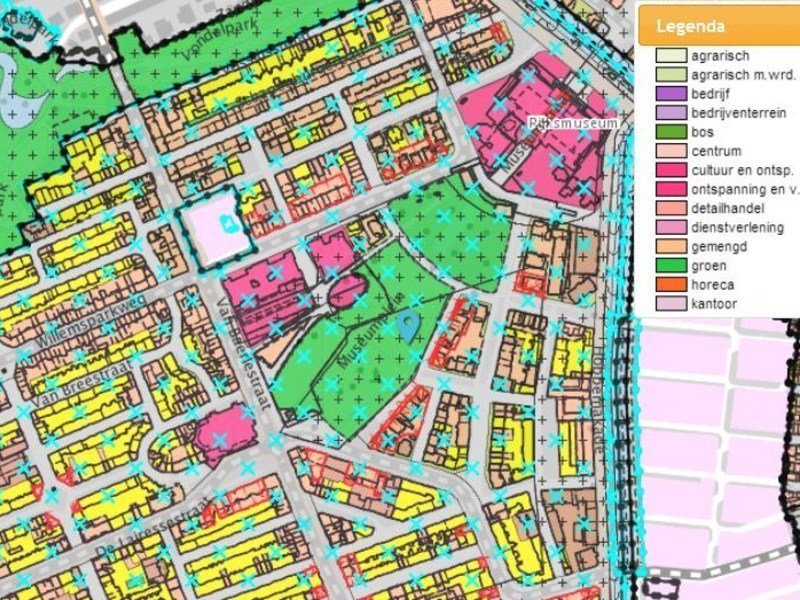

reinier.russell@russell.nl +31 20 301 55 55Is it allowed to establish business premises at a certain location or is it just a residential area? What is the permissible height of a building and are there any more conditions regarding construction or use? In the Netherlands, all these things can be found in a zoning plan. In a zoning plan, a certain purpose is assigned to plots of land and rules are set regarding the use of buildings on these plots

The use determines the function of a plot of land in the zoning plan. The function determines what can be done with the ground. For instance, a building can be attributed the function residential, or a number of plots of land can be labelled as shopping or catering area.

A zoning plan consists of three different elements, namely

Would you like to know whether you are allowed to build on a certain plot or what conditions the buildings have to meet? This can be found in the zoning plan at the municipality. Zoning plans are drafted in the Dutch language. We can assist you in finding the applicable zoning plan and will gladly provide you with an explanation of the included rules:

As of 1 January 2026, the Money Laundering and Terrorist Financing (Prevention) Act (Wwft) will change. Cash payments of EUR 3,000 or more will then be prohibited. What does this mean for the retail sector and the art trade?

The Transparency and Countering Undermining by Civil Society Organisations Act (Wtmo) imposes a number of new obligations on charities in the Netherlands. What are these? What measures should non-profit organisations take as a result?

A franchise agreement is often linked to an agreement for the lease of business premises. What happens if the franchisor and franchisee have a conflict? Does the lease agreement remain in force if there are problems with the franchise?

Almost all companies now use some form of AI. This means that they may be subject to the prohibitions and regulations set out in the European AI Act. How can you ensure that you comply with these rules?

The new Labour Supply Act (Wtta) imposes stricter requirements on temporary employment agencies, payroll companies and secondment agencies. But the Wtta also has major consequences for companies that use their services. What does this mean for their personnel policy and administration?

ANBI status makes it even more attractive to make donations, gifts and bequests to charities. What requirements must an institution meet in order to obtain and retain this status? When is something considered to be of public benefit? What information must an ANBI publish?